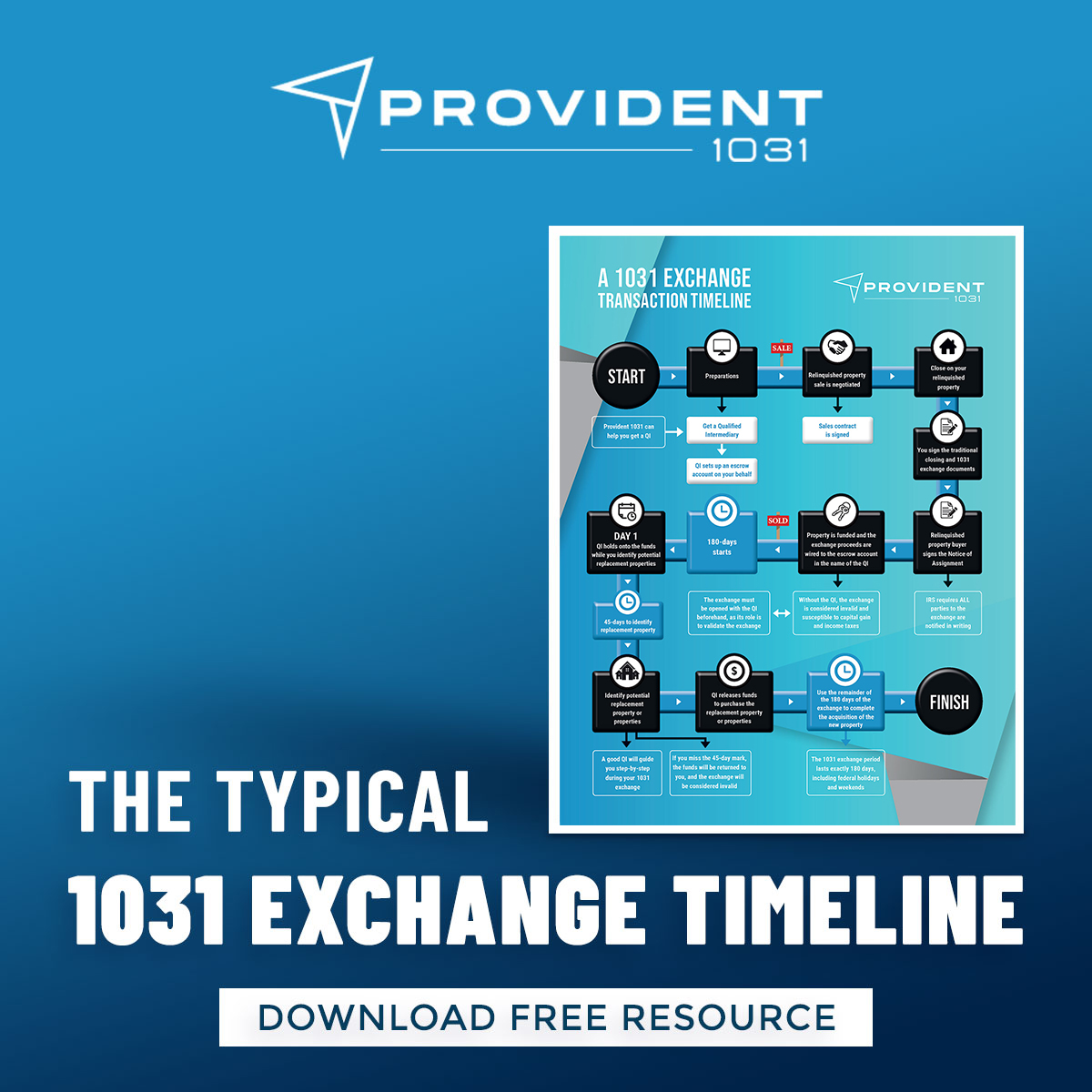

The Typical 1031 Exchange Timeline

Infographic: The 1031 Exchange Timeline

Share this Infographic Image on Your Site

<p><strong>Please include attribution to https://provident1031.com/ with this graphic.</strong><br /><br /><a href='https://provident1031.com/blog/2022/04/16/1031-exchange-timeline/'><img src='https://provident1031.com/wp-content/uploads/2022/04/P1031_1021_exchange_timeline.jpg' alt='1031 Exchange Transaction and Timeline' width='1200px' /></a></p>The 1031 Exchange Timeline

1031 Like-Kind Exchanges: Important Aspects, Rules, Concepts, and Definitions

If you’re thinking about selling your investment property to purchase another property, you should know about the 1031 tax-deferred exchange. This transaction method allows an investor to sell their investment property and buy a like-kind property while deferring capital gain taxes. (Keep in mind the definition of “like-kind” is very vague. You can sell a rental home and buy raw land and it would be considered like-kind.)

This article will cover 1031 like-kind exchanges, their important aspects, rules, concepts, and definitions you should be aware of if you’re considering a section 1031 exchange transaction.

What Is A 1031 Exchange Transaction?

Imagine you want to sell your rental property and invest in something that could provide you with reliable income while at the same time eliminating the hassles of negotiating new leases or dealing with unexpected expenses like a new roof or HVAC unit. Selling your real property and placing the proceeds in the bank may sound like a good plan. Still, you may be subject to income tax of up to 20%, net investment income tax of 3.8%, depreciation recapture of 25%, and state income taxes if applicable. You could give away a massive portion of your gains to the IRS without a tax plan or strategy.

In contrast, you may defer tax gains if you invest your sale proceeds in a DST, which allows you to co-invest with other beneficiaries in one or more institutional-quality DST investment properties. The formation of the Trust is done by DST sponsors (usually LLCs — limited-liability companies), who pool the money from smaller investors and invest it in a single, sizable real estate investment.

What Happens When You Buy A 1031 Exchange Property?

In addition to freeing up capital through tax deferral and increasing your purchasing power, 1031 exchanges also provide many other benefits, which are listed below:

1. Leverage

Using the money you would otherwise have to pay to the IRS, you can increase your down payment and improve your overall purchasing power to purchase a higher-value replacement property.

By using 1031 exchanges, investors can leverage their cash and continue to grow their wealth through real estate investing. For more information, check out my article, How Savvy Investors Use A 1031 Exchange To Defer Capital Gains and Build Wealth.

2. Consolidation and Diversification

Thanks to the flexibility of this type of exchange, investors can swap one property for several other properties, consolidate multiple properties into one, or purchase a replacement property anywhere in the US. For example, an investor could swap two properties for a larger one or swap a single property in California for three properties in Florida.

3. Management Relief

Investors who own multiple rental properties are frequently burdened by the responsibilities of intense management and costly maintenance, which can lead to increased stress.

An investor can increase revenues while saving time and effort by consolidating out of high-maintenance rental properties and into an apartment complex or NNN leased investment.

4. Increased Cash Flow

A 1031 tax-deferred exchange can improve both cash flow and overall revenue. For example, investors can swap vacant land that generates no cash flow for a business property that does.

5. The Downside

The downside of 1031 exchanges is that the tax deferral ends when you decide to sell all your property at fair market value and cash out, leaving you with a large tax payment. However, this downside fades compared to the benefits and wealth creation opportunities these exchanges provide.

Tax liabilities also end with death; in case of your eventual passing, your heirs won’t be expected to pay the tax you deferred. Instead, they’ll simply inherit the property at its stepped-up market-rate value. This provides real estate investors with a massive tax benefit and strategy that can further benefit the investors’ eventual estate planning.

The Typical 1031 Exchange Timeline

The 1031 exchange process isn’t something that happens overnight. Instead, it’s a fairly simple process that requires preparation and includes specific time limits that have to be honored. According to the exchange rules set by the IRS, you have to complete your 1031 exchange within 180 days total of selling your property.

1. Preparations

An accredited investor must engage a Qualified Intermediary (QI) and set up an exchange agreement to help accommodate the 1031 exchange by allowing the QI to open an escrow account on your behalf. Then, the old, relinquished property sale is negotiated, and a real estate sales contract is signed.

2. Day 1: Sell Your Property

Your 180-day period starts when the sales of the relinquished property have closed. You are required to sign the traditional closing documents and 1031 exchange documents. The relinquished property buyer will also sign the Notice of Assignment, as the IRS requires that all parties to the exchange are notified in writing.

The exchange proceeds are wired to the escrow account opened in your name by the Qualified Intermediary. The QI will hold onto those funds while you identify potential replacement properties and will release them to purchase the replacement property or properties.

It’s important to note that the QI officially starts the exchange period (total of 180 days) as soon as the sale(s) of the relinquished property is closed.

The exchange must be opened with the QI beforehand, as its role is to validate the exchange. Without the QI, the exchange is considered invalid and susceptible to capital gain and income taxes.

3. Day 45: Identify Potential Replacement Property

The identification and replacement period begin the day following the closing, which is a tricky part of the 1031 exchange. With the sales closed and the funds safely tucked away with your QI, you have 45 days to identify up to three potential replacement properties — candidates you are considering purchasing as the exchange property.

As an investor, you must deliver a written document or an “identification notice” signed by you and deliver it to your QI by midnight of the 45th day. If you miss the 45-day mark, the funds will be returned to you, and the exchange will be considered invalid.

Do not be intimidated by the process. A good QI will guide you step-by-step during your 1031 exchange.

4. Day 180: Close On New Property

You will use the remaining 180 days of the exchange term to complete the acquisition of the new property — you must finalize the purchase of the replacement property by day 180 of the exchange period.

It’s important to note that the 1031 exchange period lasts exactly 180 days, including federal holidays and weekends.

The first 45 days within the 180 days are reserved for identifying the new property, and the rest is given to close the acquisition of the replacement property.

Reasons You May Not Be Able To Use The 1031 Exchange

1031 exchanges do have certain limitations and restrictions the IRC imposed on swapping properties. For example, you must be the sole legal owner of the property in question, and you can’t apply partnership interests in EIT or LLC for 1031 exchanges.

You also can’t use 1031 exchanges to exchange properties, like primary residences, for personal use. This is because 1031 exchanges only apply to industrial estates and properties designated for investment purposes.

However, an alternative is that you can convert your personal property, such as a vacation home, into a rental property. However, there are still several rules and guidelines associated with this conversion, as you must rent out the residence for at least six to 12 months before it becomes eligible for a 1031 exchange.

Can you Live In Your 1031 Exchange Property?

Unfortunately, personal properties aren’t deemed as investment or business properties, and as such, they aren’t eligible for 1031 exchanges. Similarly, the relinquished and replacement properties under the 1031 exchange aren’t deemed as personal residences and can’t be used as such by the investor.

If you choose to move into your 1031 exchange property, the IRS will tax you for any capital gains for the sale of a property, and you may incur depreciation recapture. However, there are several ways investors can avoid this and convert their investment properties into primary residences.

Before you can convert your investment property into a primary residence without incurring a tax liability, you must own the property for a certain period of time.

Additionally, you must rent out the property at a fair rental price to another person, and you cannot personally use the property for more than 14 days a year. For more in-depth information, check out my article Can You Live In A 1031 Exchange Property?

Summary

1031 exchanges offer many benefits to investors, such as significant tax advantages and opportunities to grow and leverage their wealth with minimal financial liabilities. However, to fully reap the benefits and tax advantages provided by IRC code 1031, you must adhere to its strict rules and timeframes.

If you want investment advice on 1031 exchanges in a great video learning format sign up for my masterclass, Master The 1031 Exchange. Here, you can also learn about a Delaware Statutory Trust, which can greatly enhance a 1031 exchange.